Understanding the difference between online and local exchange rates in today's global economy is essential for anyone involved in investing, business, or travel. Local rates refer to exchange rates provided by the physical currency exchange outlets, banks, or ATMs within your region or at your travel destination. Online rates are, on the other hand, are the rates provided by digital platforms and financial institutions for conversion of currency. These rates are subject to substantial changes, which could be a significant influence on the cost you pay for currency exchange as well as the returns you earn from your investments. If you are aware of the differences between online and local exchange rates, it's possible to make more informed decisions that will reduce your expenses. These are the 10 most detailed tips for navigating local and online rates efficiently.

1. Understanding the difference in rates

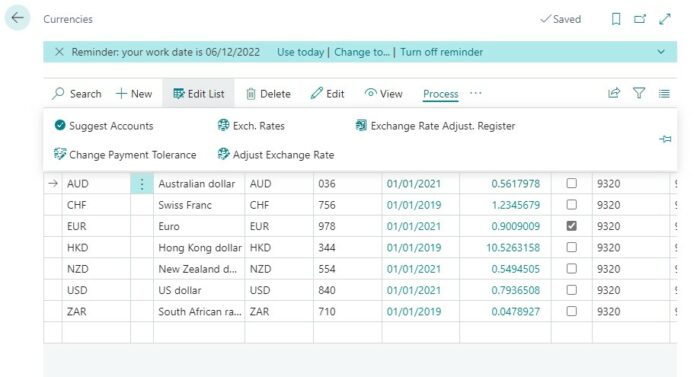

- Local exchange rates can differ significantly from online rates because of factors such as overhead costs, demand and market conditions. Local exchange services can have costs that are higher or have lower rates due to operational costs. Online platforms however typically offer higher rates due to their lower costs of operation. Understanding the difference between these two can assist you in selecting the right currency exchange service for your needs.

2. Compare rates before you exchange currency

Compare the rates of the local and online currency exchanges before you make the choice. To compare rates in real time, use website or currency converters. Check the online exchange rate with the local exchange rate at booths and banks if you are planning to travel abroad. This can help you to find the most efficient option and save some money.

3. Utilize Online Currency Exchange Platforms

Online currency exchange services such as Wise or copyright are often more competitive and provide lower fees than the local banks. These platforms usually offer live exchange rates and full transparency regarding the fees. You can obtain the most competitive exchange rates using these platforms.

4. Be aware of the Dynamic Currency Conversion (DCC)

You might be given the option of paying in your own currency when you make purchases abroad. This is referred to as Dynamic Currency Converter. While this option may seem useful, it is often accompanied with unfavorable exchange rates as well as additional fees. Reduce DCC expenses by paying in local currency. You will also benefit from better exchange rates.

5. Cost is not the only factor to consider. Cost

If you're deciding between online and local rates, consider the cost versus the convenience. Local exchanges may provide fast access to cash when you travel. Online exchanges have lower rates, but require you to set up an account and wait for funds to be transferred. Take into consideration your travel plans or business transactions, when determining which option best suits your needs.

6. Monitor Exchange Rate Trends

Knowing the changes in exchange rates can help you make better informed choices when it comes to converting your currency. Online platforms offer historical data and analytical tools that can aid you in tracking exchange rate changes. Knowing how markets work will help you plan your currency exchanges better to benefit from favorable rates.

7. Calculate ATM charges and withdrawal limitations in your area.

Be aware of any fees associated with withdrawals from ATMs in the area you reside in. Different banks may charge various fees for international transactions ATMs typically have the limits on withdrawals they have set for themselves. Doing a search for ATMs in your area prior to your travels will aid you in finding ones with lower fees or better rates, which will ensure you get the most value from your withdrawals.

8. Currency exchange services that are free are offered.

Many banks or platforms online provide no-cost currency exchange services, especially for those who have accounts. It is a great benefit for business travelers or those who deal frequently in foreign currency. Think about opening a currency exchange account for more favorable rates and lower fees.

9. Consult Financial Experts for Large Transactions

If you're dealing in large amounts of money, or an intricate exchange rate, then the guidance from financial experts is invaluable. Experts in currency provide invaluable advice on the best way to utilize local and online rates. This is important, especially for businesses or investors who are involved in international trading.

10. Plan ahead to be prepared for Currency Needs

If you're going on an official trip or travelling in a foreign country, planning your currency needs ahead of time can save you both time and money. You should determine how much cash you need to pay for your travel expenses. After that, you'll be able to decide what exchange method is the most effective. If the exchange rate isn't favorable, use an online platform to convert your currency before departing. You'll get the best rate and avoid losing money.

Follow these tips to get through the maze of currency exchange, whether you're on the road, conducting business, or monitoring your investments. Understanding the advantages of and drawbacks of each choice can help you make better informed financial choices. This can eventually save you money and enhance your overall financial plan. Have a look at the most popular united states advice for blog examples including japanese yen to usd, convert gbp to usd, pound sterling to usd, dollar to euro, us dollar to mexican peso, usd to japanese yen, usd to indian rupees, usd to japanese yen, us dollar in indian rupees, usd to pound sterling and more.

Ten Top Tips About The Limits Of Currency Exchange And Rates

These limits are vital to financial transactions. They are useful to travel abroad, investments, or business transactions. Limits are set to limit the maximum money that can easily be transacted in a specific period. They are usually set by financial institutions, payment platforms or banks. Understanding transaction limits is essential to optimize your financial strategy and avoiding costly fees or delays. Limits on transactions can influence foreign purchases as well as cash withdrawals for travellers. For businesses, they can affect payment processing as well as cash flow management. When buying or selling assets, investors must be aware of transaction limits. Here are the top 10 comprehensive strategies for limiting transaction limits in financial transactions.

1. Be aware of your bank's transaction limits

Each bank or financial institution has different withdrawal limits. Purchases. And transfers. It is important to be familiar with these limits prior to making large purchases or traveling. This knowledge can assist you in managing your finances efficiently and avoid difficulties when trying to access funds or make purchases from abroad. The limits of your account can be found on the website of your bank or through their customer service.

2. Prepare for Cash Withdrawals when Traveling

While traveling, it is essential to plan your cash withdrawals in order to remain within the limitations of transactions for your bank. You can calculate the amount of cash you'll require for your trip by knowing what your daily withdrawal limits are. Be sure to not run out of cash through several large withdrawals. If you are concerned that your withdrawals might over the limit, you should consider making a backup plan for your payment system.

3. Utilize Multiple Payment Methods

It is not advisable to rely on one single payment method because it could cause problems when you have reached the transaction limit. Ensure you can access funds at any time by using a mix of cash, credit/debit, and mobile payments apps. This approach can help you manage your finances and avoid exceeding the transaction limit on a single account.

4. Be sure to monitor your transactions frequently

Monitoring your transaction activity can help you stay alert to your spending and ensure that you aren't over your limit. Many banks have mobile apps that track your transactions live, and provide insights on your balance. Monitoring your account activity can assist you in managing your finances efficiently and avoid unanticipated issues when you purchase.

5. Contact us for more information about limitations to international transactions

Ask your bank about how they restrict transactions made in international currency when you are planning to make international purchases or withdrawals. Certain banks prohibit foreign transactions. This could limit your ability to purchase and withdraw funds while traveling overseas. Knowing these limits can assist you in planning and avoid any disruptions on your travel plans.

6. Set up alerts to monitor transactions

Many financial institutions and banks have alert systems in place to inform you when your limit for transactions is approaching or an event has occurred. Set up alerts to help keep track of your finances. This feature is particularly beneficial for those who travel frequently and are more susceptible to getting lost while abroad.

7. Be aware of daily and Monthly Limits

Transaction limits are based on different time frames for example, daily limits or a monthly limit. For instance you might find that your bank allows you a certain withdrawal amount every day, but impose an upper limit for monthly transactions. Understanding these timeframes can assist you in planning your transactions effectively, ensuring you have access to funds when needed without exceeding the limits.

8. Talk to Your Bank About Temporary Limit Increases

You should consult your bank to find out whether there are any short-term limits that can be increased. A majority of banks will accommodate requests for higher limits, providing an explanation that is legitimate. Contact your bank prior to the trip to discuss your requirements and the necessary documents to make the process easier.

Be aware of the limitations of your payment system

Pay attention to the fact that payment services like copyright, Venmo or others impose restrictions on transactions. Each platform has its own policy concerning maximum transactions and limits, which may differ based on account verification status and the history of users. Check the limitations prior to making a transaction. This will help you prevent delays and disruptions.

10. Learn More About Investment Transaction Limits

For investors, there may be limits on transactions that are in place when purchasing or disposing of assets using brokerage accounts. These restrictions could impact your ability to trade quickly particularly in volatile market conditions. Consider using limit orders and other strategies to manage your investments. Be familiar with the policy of your broker regarding the limitations on transactions.

Being aware of and managing the limits of your transactions can help you navigate the complexity of business, travel and investment monitoring more effectively. Understanding your bank’s policies, utilizing several payment methods, and planning for cash withdrawals will enable you to make better choices. This will help you avoid unnecessary fees or interruptions as well as improve your overall financial plan. Check out the top rated my website zloty for blog advice including us to peso, usd to pakistani rupee, mexican peso to usd, currency exchange near me, us dollar to mexican peso, jpy usd, gpb to usd, usdthb, usd to peso, rmb to usd and more.